The Ultimate Guide To Lighthouse Wealth Management

The Ultimate Guide To Lighthouse Wealth Management

Blog Article

Financial Advisor Victoria Bc Things To Know Before You Get This

Table of ContentsUnknown Facts About Tax Planning copyrightSome Known Details About Lighthouse Wealth Management Some Known Questions About Tax Planning copyright.How Retirement Planning copyright can Save You Time, Stress, and Money.What Does Ia Wealth Management Do?The Basic Principles Of Ia Wealth Management

Heath can also be an advice-only coordinator, which means that the guy doesn’t handle their customers’ cash immediately, nor does he sell all of them particular financial products. Heath claims the selling point of this method to him usually he doesn’t feel bound to supply a specific product to solve a client’s cash dilemmas. If an advisor is only prepared to sell an insurance-based treatment for a challenge, they might wind up steering some one down an unproductive path in title of hitting sales quotas, according to him.“Most monetary solutions folks in copyright, because they’re paid based on the products they offer and sell, they're able to have motivations to advise one course of action over another,” according to him.“I’ve selected this program of motion because I can seem my personal consumers to them and never feel I’m benefiting from all of them at all or attempting to make a sales pitch.” Story goes on below advertisement FCAC notes how you shell out the advisor is dependent on this service membership they offer.

Private Wealth Management copyright Can Be Fun For Anyone

Heath and his ilk are compensated on a fee-only product, this means they’re compensated like a lawyer may be on a session-by-session basis or a hourly assessment rate (private wealth management copyright). According to array of solutions in addition to expertise or typical clientele of your own consultant or planner, per hour costs can range within the hundreds or thousands, Heath says

This could be as high as $250,000 and above, according to him, which boxes

How Independent Financial Advisor copyright can Save You Time, Stress, and Money.

Story goes on below advertising Finding the right monetary planner is a bit like online dating, Heath states: you intend to discover someone who’s reputable, has an individuality match and is also best person when it comes down to phase of life you’re in (http://tupalo.com/en/users/6114064). Some prefer their particular advisors is earlier with a bit more knowledge, he states, although some choose some body younger who is able to hopefully stick to all of them from early years through your retirement

The Best Guide To Private Wealth Management copyright

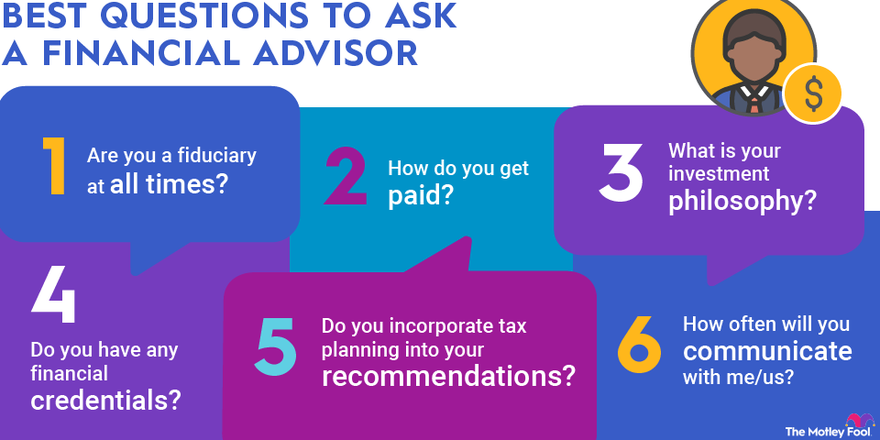

One of the primary mistakes some body will make in selecting a specialist is certainly not asking adequate concerns, Heath says. He’s astonished when he hears from customers that they’re stressed about asking concerns and probably appearing stupid a trend the guy locates is equally as common with developed experts and older adults.“I’m amazed, given that it’s their money and they’re spending a lot of costs to those individuals,” he states.“You need to own the questions you have answered therefore are entitled to having an open and honest connection.” 6:11 economic planning all Heath’s final information is applicable whether you’re wanting outdoors economic help or you’re going it alone: become knowledgeable.

Listed here are four things to consider and inquire your self when figuring out whether you ought to engage the knowledge of a financial expert. The web really worth is not your revenue, but instead a quantity that can assist you comprehend just what money you earn, just how much you save, and for which you spend some money, as well.

The smart Trick of Independent Investment Advisor copyright That Nobody is Talking About

Your child is on just how. Your divorce is pending. You’re approaching retirement. These along with other major life events may remind the need to visit with a monetary advisor regarding your financial investments, debt goals, and other financial issues. Let’s state your own mommy remaining you a tidy amount of cash within her might.

You have sketched your own economic program, but I have a tough time following it. A financial advisor may offer the accountability that you need to place check out this site your financial thinking about track. They also may advise how-to modify your financial program - http://go.bubbl.us/dec75e/3e85?/New-Mind-Map to be able to optimize the potential results

6 Simple Techniques For Financial Advisor Victoria Bc

Anybody can state they’re an economic consultant, but an advisor with specialist designations is ideally usually the one you need to employ. In 2021, around 330,300 People in the us worked as personal financial advisors, in line with the U.S. Bureau of Labor studies (BLS). Most financial advisors are freelance, the bureau says - independent investment advisor copyright. Usually, you'll find five kinds of monetary experts

Brokers generally make profits on deals they make. Agents are managed of the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) and state securities regulators. A registered expense advisor, either an individual or a strong, is a lot like a registered consultant. Both buy and sell assets for their clients.

Report this page